Ct State W4 2024

Ct State W4 2024. Pension or annuity withholding calculator. 1, 2024, regarding income tax withholding.

Due dates of installments and the amount of required payments for 2023 calendar year taxpayer are: The following ui tax changes are effective january 1, 2024:

Please Select The Information That Is Incorrect.

Full package of budget documents.

Who Must Complete A Registration Application And File A Withholding Tax Return.

12 issued an updated employer’s tax guide, effective jan.

Ip 2024 (1), Connecticut Employer’s Tax Guide, Circular Ct.

Images References :

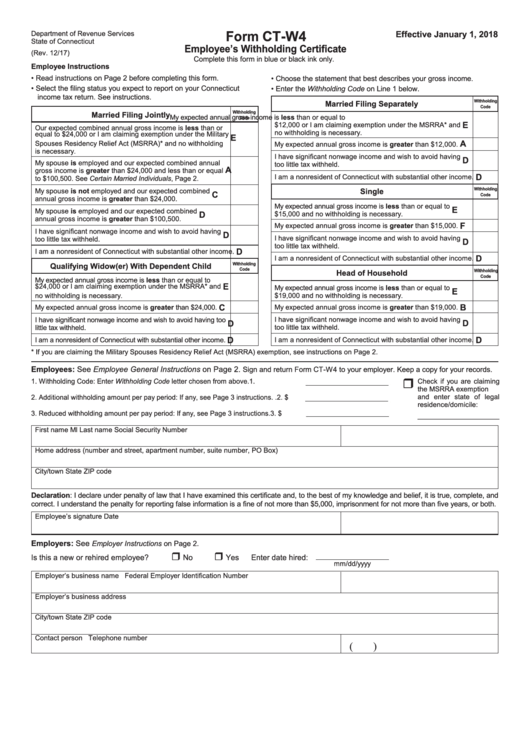

Source: mxcc.edu

Source: mxcc.edu

State W4 CT State, Middlesex, 1, 2024, affect its withholding tables and calculation rules, the state’s department of revenue services. Who must complete a registration application and file a withholding tax return.

Source: fill.io

Source: fill.io

Fill Free fillable W4 Fillable (Central Connecticut State University, As a result of fiscal responsibility and bipartisanship in 2023, i am pleased to announce that significant relief. 1, 2024, regarding income tax withholding.

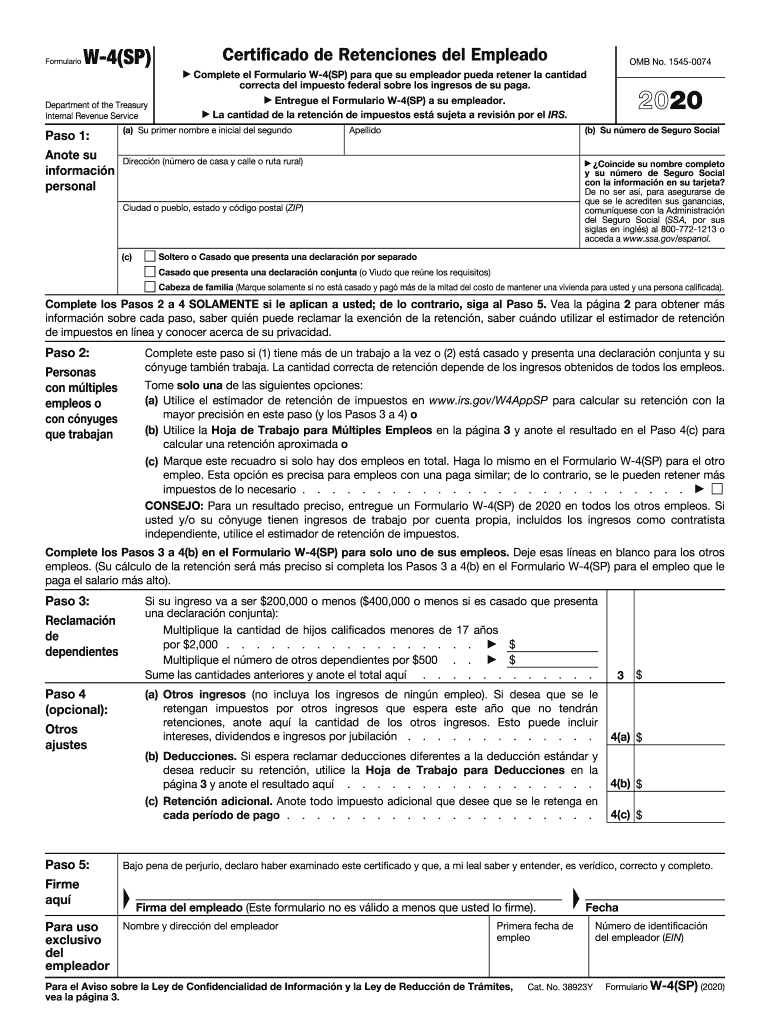

Source: www.pdffiller.com

Source: www.pdffiller.com

2020 con los campos en blanco IRS W4(SP) El formulario se puede, Due dates of installments and the amount of required payments for 2023 calendar year taxpayer are: The taxable wage base (twb) increases from $15,000 to $25,000 and is subsequently indexed annually due to.

Source: www.youtube.com

Source: www.youtube.com

How to Fill Out an Exempt W4 Form 2024 Money Instructor YouTube, The taxable wage base (twb) increases from $15,000 to $25,000 and is subsequently indexed annually due to. Ip 2024 (8), connecticut tax.

Source: form-3911.com

Source: form-3911.com

Ct state tax form 2023 Fill online, Printable, Fillable Blank, 2024 estimated tax due dates. The taxable wage base (twb) increases from $15,000 to $25,000 and is subsequently indexed annually due to.

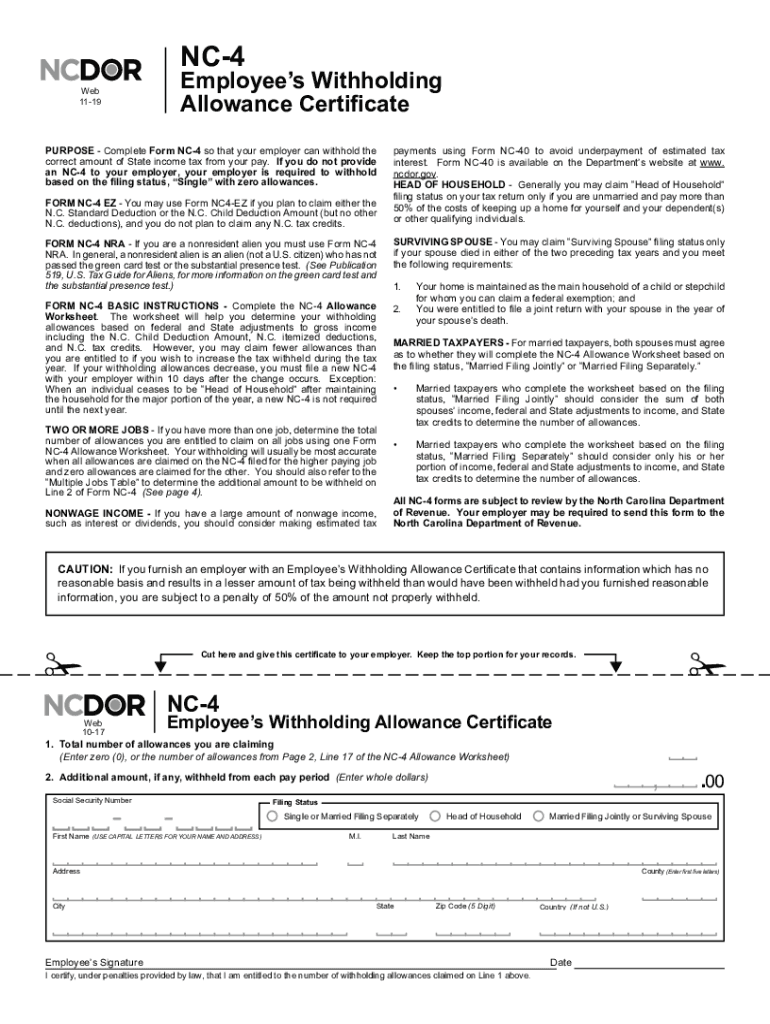

Source: www.signnow.com

Source: www.signnow.com

Nc W4 20192024 Form Fill Out and Sign Printable PDF Template, Amended connecticut reconciliation of withholding: Ip 2024 (1), connecticut employer’s tax guide, circular ct.

Source: w4formsprintable.com

Source: w4formsprintable.com

Ct Tax Withholding 2021 2022 W4 Form, This calculator is intended to be used as a tool to calculate your monthly connecticut income tax. Pension or annuity withholding calculator.

Source: www.formsbank.com

Source: www.formsbank.com

Form CtW4 Employee'S Withholding Certificate printable pdf download, This calculator is intended to be used as a tool to calculate your monthly connecticut income tax. Due dates of installments and the amount of required payments for 2023 calendar year taxpayer are:

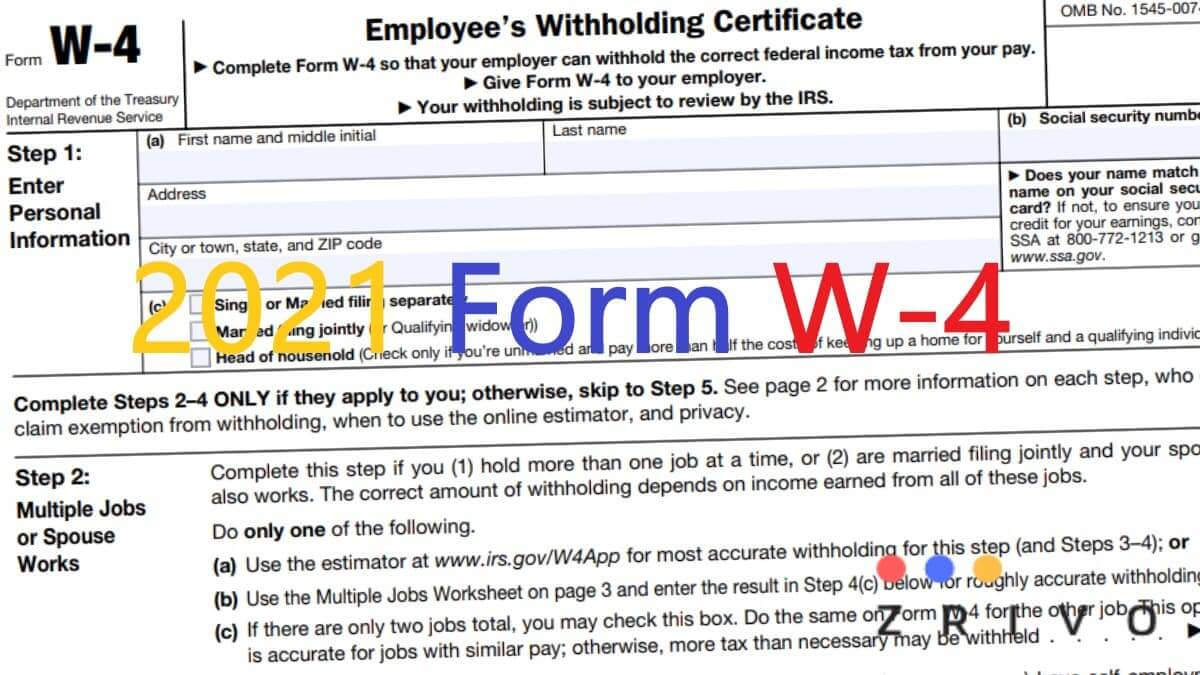

Source: www.zrivo.com

Source: www.zrivo.com

W4 Form 2023 2024, 2024 estimated tax due dates. This calculator is intended to be used as a tool to calculate your monthly connecticut income tax.

Source: dalennawgenna.pages.dev

Source: dalennawgenna.pages.dev

Irs W 4 Calculator 2024 Dedie Eulalie, Due dates of installments and the amount of required payments for 2023 calendar year taxpayer are: The income tax rates and personal allowances in connecticut are updated annually with new tax tables published for.

Ip 2024 (8), Connecticut Tax.

Amended connecticut reconciliation of withholding:

Ip 2024 (7), Is My Connecticut Withholding Correct?

1, 2024, affect its withholding tables and calculation rules, the state’s department of revenue services.